WEALTHY foreigners who move to Spain are facing financial headaches as Spanish authorities launch what one law firm describes as a ‘tax inquisition’.

International law firm Amsterdam & Associates has launched a scathing campaign called ‘Spanish Tax Pickpockets’ after being contacted by 80 victims – many of them British – whose ‘lives have been ruined’ by unexpected tax investigations.

“What Spain is doing to expats would embarrass a mafia don,” Robert Amsterdam told The Telegraph this week, claiming that tax probes are ‘inconsistent’ with European law and human rights standards.

Spanish tax inspectors reportedly receive bonuses for hitting collection targets, with a €95 million bonus pot reported in 2019 to incentivise raising €150 billion in tax revenue.

READ MORE: Irish expat in Spain says his mental health is ‘far better’ despite ‘much lower’ salary

Critics argue this encourages arbitrary investigations, with foreigners who lack the friends and allies in the right places as the prime targets.

Most affected expats choose to pay rather than fight, fearing escalation if they challenge the authorities.

However, when taxpayers do appeal, they often succeed – with reports suggesting taxpayers win over half of all disputes.

At the heart of the controversy is the so-called ‘Beckham Law,’ a tax break introduced in 2005 that allows qualifying foreign workers to pay a flat 24.75% tax rate on Spanish income up to €600,000 per year – significantly lower than the progressive rates up to 47% paid by Spanish nationals.

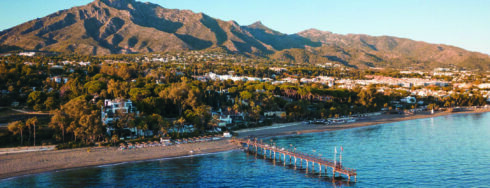

The law, named after footballer David Beckham who was among the first to benefit when he joined Real Madrid, has attracted thousands of high-earning Brits to Spanish shores.

READ MORE: Unemployment falls to lowest February rate in Spain for 17 years

But now many expats are having their tax status reassessed after years in the country, according to experts, who claim the process appears ‘discretionary’ and lacks transparency.

Victims report being ‘denied any explanation of why they are being audited’ and unable to challenge investigations until they’re nearly complete.

Mark Stücklin, founder of Spanish Property Insight, describes the situation as ‘systemic’ with ‘poorly defined tax regulations, aggressive inspectors chasing bonuses, weak oversight, and a view of wealthy foreigners as easy prey.’

READ MORE: Number of young women and girls on anti-depressants DOUBLES in Spain – experts blame ‘gender bias’

The crackdown comes amid other moves targeting foreign residents, including the imminent end of the ‘golden visa’ scheme on April 3, and Prime Minister Pedro Sanchez’s January announcement of plans for a 100% tax on property purchases by non-EU residents living outside Spain.