To the surprise of some, Spanish property has seen growth in 2024 despite previous cooling trends and sustained 4% interest rates.

Q1 2024 saw a 0.2% increase in home sales, marking the first growth in one and a half years. This highlights that the market has normalized heightened interest rates as a base level and the post-pandemic environment, with the market now recovering.

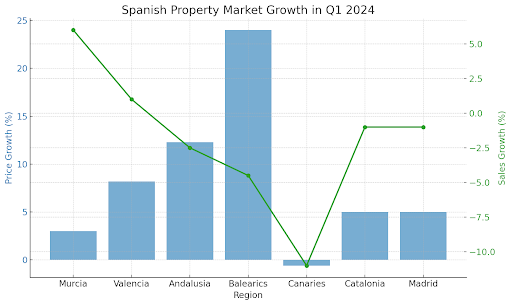

Murcia is among the most popular foreign investment markets, particularly among Brits. Sales increased 6% in Murcia and 1% in Valencia.

When it comes to prices, regions across the board are seeing growth. Year-on-year growth has been annualized at 5% in Q1 of 2024, as the Balearics lead the way at 24%. Valencia, Andalusia, and the Canaries are all around the 6-8% growth range, while Madrid, Catalonia, and Murcia are just short of 5%.

Traditionally, Costa del Sol, Costa Blanca, and Balearics have been of the most interest due to their amenities and climate. In recent years, Andalusia, with popular regions such as Marbella, Sotogrande, and Ronda, has also had high international interest.

The south of Spain has also become the capital of wellness in Europe. Yoga, Tai Chi, Ayahuasca, and meditation retreats can be found all over thanks to the year-round sun and affordable land.

Although the number of Brits that expatriate to Spain has been decreasing for some time, this hasn’t affected other nationalities from seeing Spain as desirable. There are currently more Italians in Spain than there are British.

The Spanish government has also initiated the process of abolishing the golden visa program, which is a three-year renewable residence permit. As of today, 94% of these visas are linked to property investment according to Pedro Sanchez.

The program was successful in its attempt to attract capital during the eurozone crisis. However, with housing shortages in the inner cities, the program has become controversial, particularly with the rising rents, and is thus soon to be abolished.

Logically, this is thought to hurt the luxury prime property market. However, industry thought leaders such as Knight Frank remain optimistic about the luxury market in 2024 and claim much of the recovery depends on investor confidence, with positive signals from Australia and India.

Of course, many locals are happy with this policy in its attempt to fix certain housing problems. However, the Association of Real Estate Consultants (ACI) claims this is misguided, and is worried about the broader message of the policy.

Luis Valdés, a Managing Director at Colliers, claims that the impact in essence is negative, but also minimal. Valdés puts forward the argument that most investors from overseas aren’t using the golden visa, and instead are interested in the local quality of life, leisure facilities, and safety. Engel & Völkers also confirm this position in believing this will not be a disaster, claiming golden visa property purchases only accounted for 2% of transactions in 2023.

Currency Impact on the Spanish Real Estate Market

The current spot rate for EUR/USD is 1.087, which was briefly around 1.124 around a year ago. This is part of a broader, decade-long trend of dollar strengthening, which has been making Spanish properties more affordable to American buyers.

Between 2019 and 2021, the number of Americans living in Spain grew 13% despite the pandemic.

One concern throughout Brexit was a weakening pound. However, in part due to the comparatively high-interest rate strategy from the Bank of England, along with market adjustments dating back to 2016, the pound has remained stable against the Euro at around 0.85.

This stability favors regions popular among retirees, as there has been no volatility regarding pension income, which can otherwise impact feelings of insecurity.

The Euro’s global importance is on a general decline across many metrics, from the Euro area’s share of global GDP, exports and imports, debt securities, and as a global reserve currency. From 2009 to 2017, the euro’s share in reserves declined from 25% to 21%.

Since the Russia-Ukraine war, along with the ECB’s struggle to manage interest rates while keeping Spain’s debt repayments manageable, the Euro has generally performed poorly across the board.

As a result, local purchasing power has struggled, but interest from migrants outside of the eurozone has begun to grow again.

Market Predictions and Future Growth

Despite the challenges it has faced and the underwhelming currency performance, the EU is showing its resilience with expected ECB rate cuts next week. Despite an uptick in inflation, the European Central Bank is looking to jump ahead of the Fed — who are usually the leaders in monetary policy — by cutting rates by 0.25% and giving the economy a well-needed boost.

The bravery comes from the concern that the euro will further struggle, as it will now be comparatively less attractive than the dollar. However, this is suited to those looking to buy a property — not only because of a potential hit to the euro — but it could indicate falling mortgage rates and a boost to the local economy.

There are some challenges that the Spanish property market faces, namely the abolishment of the golden visa and high unemployment. However, with experts talking down the impact of the golden visa decisions, and Spanish growth and labor market resilience forecasted to improve, it’s clear that interest in the typical tourist hotspots will only continue to grow.

It’s possible we may see a shift towards rental properties in affordable towns due to a potentially challenged luxury market, along with inner-city growth driven by digital nomads, but expat-focused prime property remains extremely desirable. Properties focused on the AirBnB market for remote workers, such as Malaga, are expected to continue their controversially rocketing prices.

Areas close to popular airports, such as Alicante, are also desirable. Here, there can be a rare mix of open spaces with affordable land, yet within proximity to major airports and touristy beach towns.

It’s clear that expatriate patterns can heavily influence local markets. While retiree Brits may face more challenges post-Brexit, retiree Americans could help fill the gap in similar areas.

Cheaper Means of Transfer and Hedging

There are dozens of money transfer services that enable you to send money from almost virtually anywhere to Spain, either over the phone or through an app, or a combination of the two.

These two types of money transfer companies are known as “digital providers” as opposed to “brokers.

Digital providers have gained a tremendous amount of popularity in the last decade and apps like Wise and Revolut are really household names – not only in the UK and Europe, but worldwide. These are some of the most successful Fintech there are and they were created to address a very pressing concern that we all know all too well as expats, the somewhat unbelievable cost of international money transfers with banks.

For larger transactions, such as property purchases, brokerages like Currencies Direct, Key Currency, and TorFX provide a more specialized service. These companies cater to individuals and businesses requiring substantial money transfers, offering personalized service and expertise. One of the key advantages of using a brokerage is the ability to hedge against currency fluctuations. Hedging services allow buyers to lock in exchange rates for future transactions, providing certainty and protection against market volatility.

Luis Valdés, Managing Director at Colliers, notes that the appeal of the Spanish market goes beyond just the cost savings. “Most overseas investors are drawn by the quality of life, leisure facilities, and safety Spain offers,” he explains. By minimizing the expenses associated with financial transactions, buyers can allocate more of their budget towards their property investment, enhancing the overall value of their purchase.

The impact of these financial tools on the Spanish real estate market is significant. Lower transfer costs and the ability to hedge effectively mean that international buyers can manage their finances more efficiently, reducing the overall cost of property transactions. This financial efficiency supports sustained investment in the market, even as other factors, like the abolition of the golden visa, present challenges.

Moreover, the availability of affordable and reliable money transfer services helps maintain the appeal of Spanish property to a diverse range of international buyers. As digital nomads and retirees from various countries continue to find Spain an attractive destination, these financial tools facilitate their ability to invest in property without the burden of excessive transfer fees.