SPENDING in shopping centres and retail parks rose by 7.9% in the first quarter of 2024, compared to a year earlier, with figures up 19.4% on the pre-pandemic year of 2019.

The statistics have been produced by PwC for the Association of Owners (Apresco).

The survey shows that record sales figures were recorded in 2023- 9% higher than in 2022 and 14% above those of 2019.

READ MORE:

- Food-flation in Spain: Cost of the average shopping basket has soared by 47% since Covid

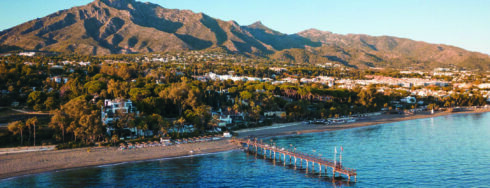

- New shopping centre opens in Estepona this week featuring sports store, a gym and restaurants

- Popular shopping centre on Spain’s Costa Blanca reports record visitors and announces improvements

“This positive trend,” said report published on Tuesday, ‘continues into the first quarter of 2024 ‘and is at an all-time high with 12 consecutive quarters of continued growth.

Apresco president, Jose Manuel Llovet, said the retail sector represents over 1% of Spain’s GDP and employs almost 900,000 people directly and indirectly.

The report states that the sector has carried out ‘a large volume’ of investments in reforming shopping centres, calculated at over €200 million last year.

It adds that the industry is very focused on improving sustainability, and highlights that the investment market ‘is beginning to see the attractiveness of this type of asset’.

In fact, the analysis underlines that ‘we are beginning to see’ a rebound in operations and investment levels, driven by the expected reductions in interest rates and the increasing interest of banks in financing operations of this kind.

The increase in sales this year has been in all kinds of fields, with leisure and entertainment standing out- up 19.3% on a year ago, and 2.6% more than between January and March 2019.

There was sales growth for home, DIY and electronics outlets in the first quarter, with a 10.5% increase year-on-year, while catering establishments grew by 9.5% and fashion and accessories sales by 6.1%.

In terms of assets, retail parks were the best performers with a 3.8% increase in sales compared to the first quarter of 2023.

Both large (40,000 m2) and medium and small (5,000 to 40,000 m2) shopping centres boosted sales by around 8%.

Footfall to shopping centres and parks increased by 6% last year and continued that trend during the first quarter of 2024, with 2.8% more visitors than in the same period of 2023.

As for the average occupancy rate of commercial units, the report says that it stood at 94.4% in the first quarter of the year, reaching the highest levels since 2018, with retail parks leading the way in occupancy, at almost 98%.

The study also says that e-commerce has experienced a ‘lower penetration than expected’ in Spain and notes a ‘slowdown’ in its growth.

Based on the report, Apresco believes that shopping centres have been able to maintain and even increase their market share and will continue to do so if they continue with renovations and improvements.