TAXES are complicated enough in your home country, but when you’re working abroad they can get even stickier. Fortunately, foreigners working in Spain can get huge tax savings through a law passed in 2005, known colloquially as the “Beckham Law.”

Meant to attract foreign talent to the country, the law essentially allows foreign residents working in Spain to pay taxes as non-residents during their first six years in the country.

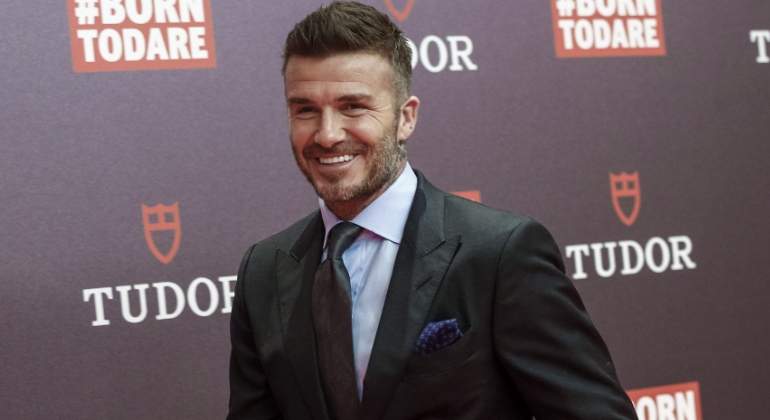

Before the Beckham Law — named after footballer David Beckham, who was among the first foreigners to benefit from the law — everyone who resided in Spain for more than six months automatically became tax residents, subject to Spain’s tiered income tax system.

This meant all income earned in Spain — whether obtained in Spain or from abroad — was taxed progressively, beginning at 19% for the lowest income brackets, increasing to nearly 50% for those earning more than €60,000 per year.

But now, foreign residents who apply for the Beckham Law pay the fixed rate applied to non-tax residents, which is 24% for those making less than €600,000.

Above this amount, the rate defaults to a fixed 45%.

This law is particularly advantageous for foreigners living in Spain who still earn money from sources abroad, as they can avoid paying tiered taxes on worldwide income.

Importantly, this law applies only to the year in which you move to Spain and the following five years, meaning that after six years, you would become an official tax resident and begin paying the tiered income tax rates on all income as Spaniards do.

Who is eligible?

Almost all foreign workers residing in Spain can apply for tax reductions under the Beckham Law.

This includes foreigners who have recently moved to Spain for work, high-net worth individuals with high-ranking job positions, most remote workers, workers with a “highly skilled professional” work permit who earn 40% of their income from their permit activities, workers with an administrative position at their company, and spouses or children of remote workers.

The only exceptions are self-employed workers and, rather ironically, professional athletes, who are not eligible to apply for the Beckham Law.

While eligibility is inclusive, there are some additional prerequisites.

Workers applying for tax reductions under the Beckham law must not have resided in Spain during the past five years, and must have moved to Spain for work reasons — meaning they must have a job contract with a Spanish company — and the majority of their professional activities must take place in Spain, so income from abroad must not exceed 15% of their overall earnings.

How to apply

To apply, simply fill out the model 149 tax form and send it to the Agencia Tributaria, along with a passport and NIE number, job contract and social security number.

It is essential to apply within six months from the date you are registered in the Social Security system as an employee of a Spanish company.

Failure to do so will result in rejection.

READ MORE

- This region in Spain has virtually abolished inheritance tax

- Amanda Butler explains the mysterious ‘Beckham Rule’ and looks at developments in Mallorca’s property market