Even if you’re not actively using cryptocurrencies, you’ve probably heard them. The concept of cryptographic payment was first mooted in the 1980s. However, it wasn’t until 2008 that cryptocurrencies as we know them today burst onto the scene. Since then, thousands of cryptocurrencies have come and gone. It’s not exactly been smooth sailing for the original cryptocurrency, but despite Bitcoin price volatility, it remains one of the most promising digital currencies around.

How the Bitcoin Market Price Has Changed Over the Years

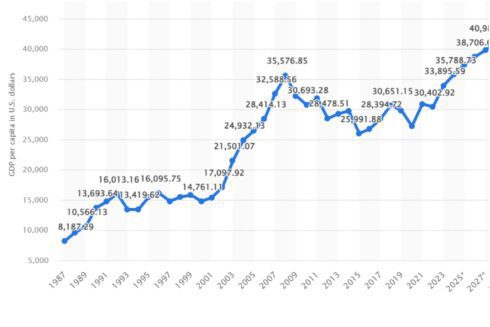

When the cryptocurrency was finally introduced in January 2009, the Bitcoin selling price stood at zero. However, the price of Bitcoin would rise steadily over the next two years. By April 2011, the Bitcoin selling price was $1. Just a few months later, this had surged to almost $30.

The 2011 Crash

Sadly, the boom time was short-lived. After a steady rise, the crypto market experienced its first major crash in late 2011. As with other early cryptocurrencies, the Bitcoin market price plummeted. However, it would quickly recover some of its value, with the crypto market stabilizing in 2012. The next year would prove more fruitful. By the end of 2013, the Bitcoin selling price was more than $1,200. These peaks and troughs would become the standard for the rest of the decade. Bitcoin price reached an all-time high at the end of 2017, forcing dubious investors and economic experts to start taking crypto seriously.

Bitcoin as a Safe-Haven Asset

In 2020, worldwide lockdowns were throttling economic growth. With many people anticipating a global recession not seen since the 1920s, many would-be investors were looking to safe-haven assets to weather the storm. In days gone by, government bonds and gold equities were the first port of call. Now, it was cryptocurrencies like Bitcoin stirring up interest. By the end of the year, the Bitcoin market price was on the rise, with an increase of more than 400% when compared to January 2020. This upward trend would continue, with a new Bitcoin market price record set within the first week of 2021.

Continued Volatility and the Crypto Winter of 2022

Volatility would define Bitcoin’s fortunes for the next year and a half. This isn’t unusual with crypto assets, but the steady decline in Bitcoin price was hard to ignore. By the end of 2021, the crypto market was in a precarious state. The value of leading cryptocurrencies like Bitcoin and Ethereum had dropped considerably. The decline was so significant that many economists were suggesting that the crypto bubble had finally burst for good. Fortunately, this didn’t come to pass, with Bitcoin surviving the so-called crypto winter. Since then, it’s enjoyed steady gains but has yet to shake off its volatile price history completely.

What Factors Impact Bitcoin Price?

Supply and demand is arguably the most important driving factor influencing Bitcoin selling price. When there’s a greater demand than there is supply, the current Bitcoin price goes up. It’s true of any commodity, digital or otherwise.

The cost involved with mining for Bitcoin tokens is another major factor. Mining for new tokens comes with considerable energy demands and hardware requirements. Equipment costs are huge, while the electricity demands required to power a mining operation are beyond the reach of small-time operations. As the cost of mining increases, so too does Bitcoin price.

In 2013, there were around 50 Bitcoin alternatives. By 2023, there were almost 9,000 active cryptocurrencies. This is only a fraction of the cryptocurrencies that have emerged and been devalued over the past decade. Many cryptocurrencies fail to make an impression, but the odd few bring exciting innovations to the market. Rather than serving as healthy competition, these alternative cryptocurrencies can steal investors and interest from Bitcoin, resulting in a decline in value.

What Are Bitcoin’s Long-Term Prospects?

Many companies already accept Bitcoin as a form of payment. In some countries, you can use Bitcoin tokens to dine out at Burger King or pay a cell phone bill. Leading travel agencies and major sporting franchises have also embraced Bitcoin as a legitimate method of payment alongside traditional fiat currencies.

Will Bitcoin ever become universally accepted? If governments are prepared to ease restrictions and encourage adoption, an increased demand is unavoidable. This would quickly lead to a Bitcoin market price increase. What’s more, wider adoption would likely lead to technological innovations that would finally make Bitcoin and the blockchain an accessible and reliable alternative to fiat currencies.

However, this potential future is unlikely to be realized. Volatility is a hallmark of the crypto market and is almost certain to remain so. While some governments seem more open to the idea of relaxing regulation, there’s no consensus between jurisdictions. A slow and steady integration into everyday life is possible.

There’s still a lot of uncertainty surrounding cryptocurrencies, with most people only having a superficial knowledge of the market. However, let’s consider the gradual adoption of e-wallets. Unlike cryptocurrencies, e-wallets don’t have any inherent value, but instead facilitate electronic transactions. Launching in 1999, the takeup of PayPal was slow, with many people questioning just how secure the service was. By 2021, more than half of all online transactions are carried out via PayPal and other e-wallets. By 2025, they’re expected to outpace traditional methods like credit and debit cards.

Current Bitcoin Price: Is the Original Cryptocurrency Still Worth Investing In?

Even after the Bitcoin crash of 2022, this cryptocurrency remains a lucrative investment avenue. Although it’s endured a volatile history, it’s established enough that we can see how quickly the Bitcoin market price can recover. What’s more, Bitcoin halving events mean that supply is never going to outpace demand, offering some level of protection for the Bitcoin selling price. What’s more, you don’t need to be an industry insider to start investing in Bitcoin. If you’re a complete beginner, turn to cryptocurrency exchanges to start your investment journey.