Were you aware that more than 10,000 individuals from the United Kingdom alone purchased a home in Spain in 2022? These figures clearly illustrate that the Iberian peninsula has become one of the most popular regions for those who wish to enjoy a bit of fun in the sun. However, it is just as important to point out that Spanish property investments are often capable of providing an additional source of income and the prices themselves can be much lower when compared to other European destinations.

The only possible issue is that the mortgage process can be tricky. Understanding the price dynamics associated with specific regions may also cause a bit of confusion. This is why a growing number of buyers are taking advantage of mortgage calculators. What benefits can these clever algorithms provide and how can they assist you in obtaining the home of your dreams?

How Does a Mortgage Calculator Work?

One of the most appealing aspects of these online tools involves their user-friendly nature. They automatically calculate variables such as the amount that you wish to borrow, the repayment term and the relevant interest rate. The main takeaway point here is that you will be provided with an accurate estimate of future monthly instalments, the up-front deposit and the aggregate cost of the mortgage itself. Take a look at this Spanish mortgage calculator to appreciate just how straightforward the process can be.

Why Opt for a Spanish Mortgage as Opposed to Paying Cash?

Some potential buyers may contemplate purchasing a Spanish home or property with cash alone. While this may be tempting at first glance, cash lump sums are associated with a handful of undeniable drawbacks. One of the most relevant is the simple fact that the funds themselves will be tied into the property for an extended period of time. This can present a real issue if real estate and land prices fall or should inflation rates rise.

Another practical consideration may involve the condition of the home itself. Some Spanish properties will require a fair amount of renovation. Mortgages will also provide owners with much more liquidity in order to make vital improvements; an undeniably practical advantage.

The Beginning of a Market Boom?

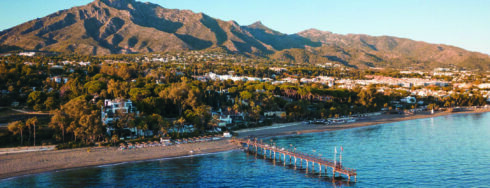

Not only will a mortgage allow buyers to afford truly magnificent properties without sacrificing their long-term liquidity, but the current state of the Spanish housing market is just as critical to highlight. Nationwide prices rose by more than five per cent in 2022 and certain regions exceeded this figure. The most popular mainland markets currently include Madrid and Barcelona. Perhaps more importantly, the Balearic Islands (Marbella, Majorca and Ibiza) have also become havens for those who are keen to enjoy the Iberian peninsula to its fullest.

The good news is that this could be only the beginning. Many experts firmly believe that the Spanish housing market is still undervalued. This is why considering a purchase in the near future could represent an excellent way to take advantage of truly amazing opportunities.

Keeping Things Simple

While there is no doubt that a great deal of research will be required before committing to a purchase, there are many ways to gain clarity and insight from the beginning. Using a reliable online mortgage calculator enables buyers to make the best decision based on their financial needs as well as to appreciate the options at their disposal. The home of your dreams may very well be closer than you think!