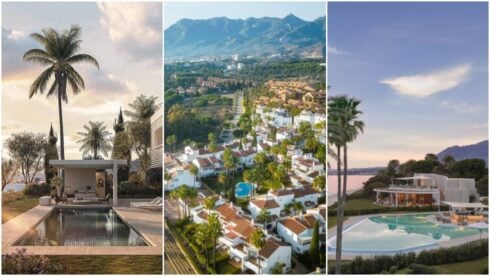

THE average international buyer of Spanish property has begun to trend downwards in age profile, according to the latest data.

While there are still plenty of Brits, Germans, French and Belgians coming in to hand over their cash for a slice of life in the sun, gone are the days of them being entirely high-income, near-retirement couples.

The prevailing trend among international buyers indicates the new sheriffs in town are a younger, less financially comfortable demographic, nonetheless sure enough of themselves to get onto the Spanish property ladder.

These young upstarts have been capitalising on the freedom afforded by the digital nomad lifestyle to invest in Spanish property.

UCI’s analysis shows that the Covid pandemic unleashed the genie of the home office and flexible working, which has seen a surge in younger buyers drawn by this way of working.

Thus they can fulfil the dream of spending extended periods on the Spanish coasts without waiting until they are grey and wrinkly.

As the Olive Press has reported recently, buyers from the United States have also surged onto the scene, according to insights shared by the Union de Creditos Inmobiliarios (UCI).

Despite the fact that interest rates on mortgages for non-residents are invariably higher compared to those offered to foreigners residing in the country, the Spanish property market continues to witness a surge in demand from international buyers

The numbers are underlined by a dramatic 45% surge in foreign property transactions in 2022, totaling 88,800 transactions.

This data, sourced from the College of Registrars and cited by UCI, paints an optimistic picture for 2023.

Importantly, the first quarter of the year already witnessed 23,380 transactions by foreigners.

The UCI noted that the maximum financing percentage typically hovers around 70% of the property’s valuation or purchase price.

Additionally, these mortgages offer an amortisation period of around 30 years, albeit with some exceptions.

Spain’s attractiveness, enviable quality of life, profitability, and its status as a stable safe haven for investments have not, it seems, been dented by the upward trajectory of interest rates.

READ MORE:

- REVEALED: The most expensive holiday destinations in Spain this year – and the cheapest

- Exclusive Recognition: Restaurant in Spain’s Andalucia awarded prestigious Sustainable Sun Award from Repsol Guide

- RANKED: The place to be this summer season in Spain? It’s the Costa del Sol, baby

Click here to read more Property News from The Olive Press.