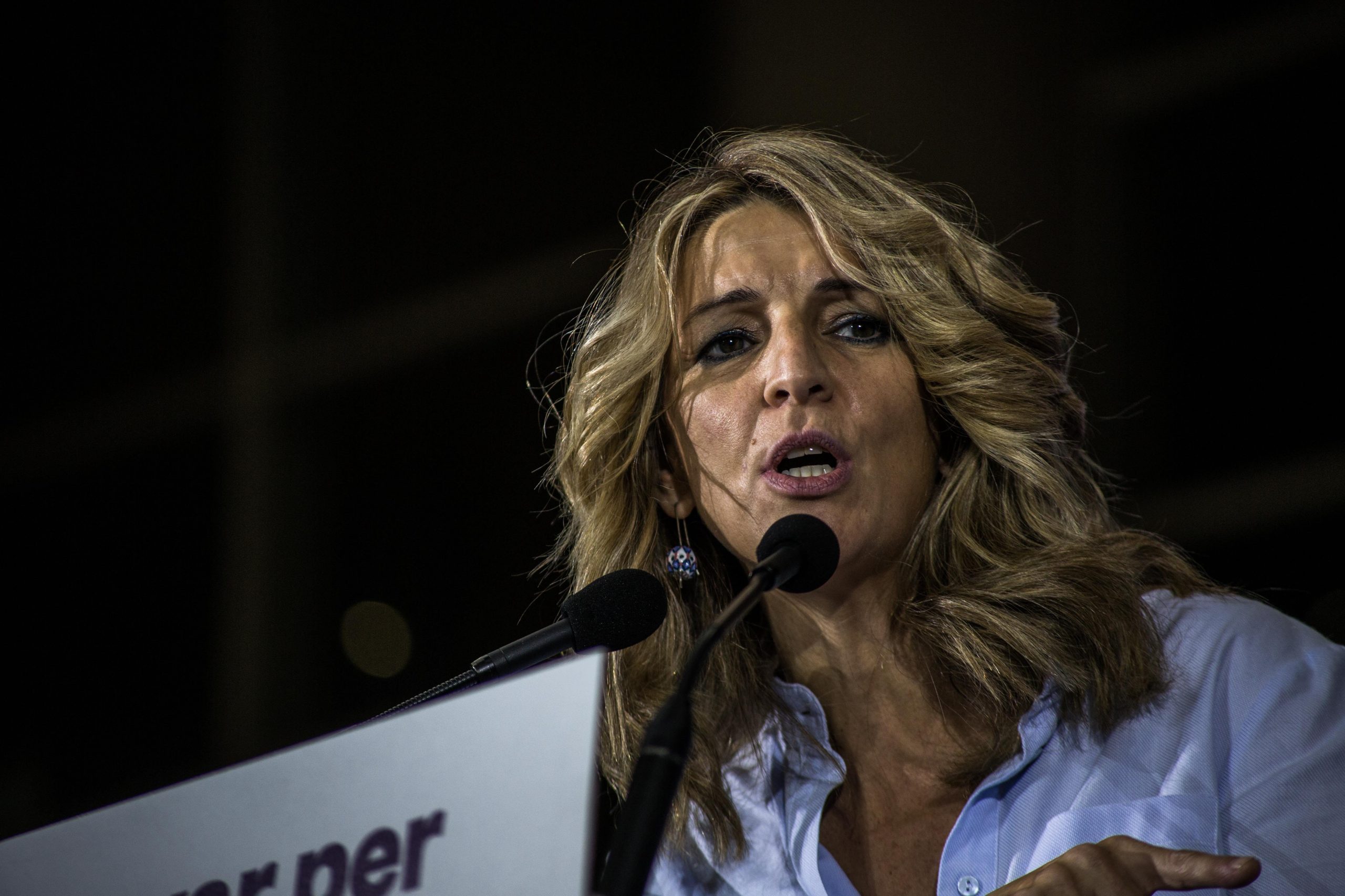

SPAIN’S deputy prime minister and labour minister, Yolanda Diaz, on Wednesday called on the banking sector to freeze mortgage interest rates and curb its profits after one of the country’s lenders announced record earnings.

BBVA, which is Spain’s second-biggest bank by market value, released its 2022 results today. They showed a 38% increase in net profits, which came in at an all-time high of €6.42 billion.

This was partly due to a double-digit rise in lending income, as well as the bank’s performance in Mexico, according to figures cited by news agency Reuters.

BBVA has been expanding in emerging economies such as Mexico’s, where there are more opportunities for growth than in its traditional markets.

The country accounted for more than 60% of the lender’s net earnings in 2022. Net profits in the North American nation rose 64% in 2022, while income from lending was up by 44%.

The figures from the bank came just a day after it emerged that the Euribor interest rate, the benchmark used for the calculation of most mortgages in Spain, continues to rise. From December to January, for example, the rate went up from 3.018% to 3.337%.

Writing on Twitter, Yolanda Diaz – who is a member of the leftist Unidas Podemos party – said that the current cost-of-living crisis ‘cannot be an excuse to earn more’.

‘While the rise of the Euribor will make the average mortgage €250 a month more expensive, BBVA’s profits have grown 38%,’ she continued.

Read more:

- Borrowers in Spain face rising mortgage repayments as Euribor shoots up

- Sabadell Bank says ‘no plans’ to close branches this year in Spain as profits soar

- Number of bankers in Spain earning over a million euros grew from 128 to 221 in 2021