FOOD retailers in Spain have welcomed Tuesday’s government decision to cut IVA rates on basic products from January 1, but have warned of frantic last-minute work to get everything ready.

IVA will be exempted from basic foods while tax will go down from 10% to 5% on oil and pasta.

The Asedas association represents distributors, grocery stores, and supermarkets with 322,000 staff employed in over 19,000 outlets.

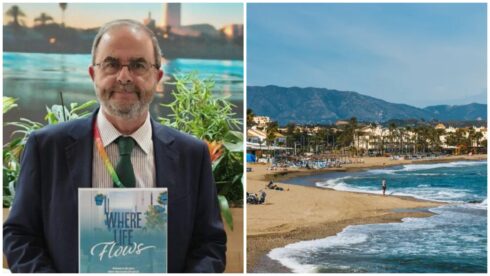

Asedas general director, Ignacio Garcia Magarzo, said: “It would have been better to have been given more time for us to act.”

An estimated 7,000 products will need to get their prices changed.

“Many people are going to have to work on New Year’s Eve,” a supermarket employee told the El Pais newspaper.

There’s no precedent for an IVA tax change with so little notice.

Supermarkets will have to update their computer systems to take account of the new prices.

A source told El Pais that major retailers approached the government to ask them to postpone the change for a week, but the suggestion was rebuffed.

Large chains are not expected to have problems from the technological standpoint at checkouts, but there’ll be the practical issue of changing all the price displays on shelves.

For smaller groups and independent retailers, it will mean more work for them to meet the end-of-year deadline.

Prime Minister Pedro Sanchez said on Tuesday that all tax cuts will have be passed on directly to customers.

The government is hopeful that the negative effect on inflation with the ending of the 20 cent fuel subsidy will be offset by lower food prices.

READ MORE:

Click here to read more Spain News from The Olive Press.