HOME repossessions in Spain caused by mortgage payment defaults have fallen for the first time in nearly two years.

Figures released on Wednesday by the National Institute of Statistics(INE) covering the second-quarter of 2022 showed 3,165 repossessions.

That’s a fall of 4.1% compared to the April-June period of 2021 and is the first drop after rises over seven consecutive quarters.

The reduction comes in spite of rising inflation in Spain coupled with tougher government rules during the pandemic concerning repossessions.

Around half of the seized properties were on mortgages taken out between 2005 and 2008.

The biggest quarter for repossessions was between April and June in 2014 as the ‘bursting’ of the real estate bubble was in its prime.

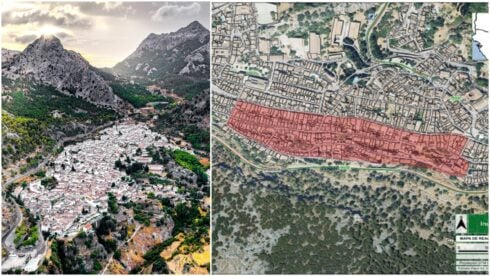

The bulk of home repossessions for the second quarter of 2022 were in the Valencian Community (1,054), Andalucia (1,041) and Catalunya (804).

The lowest numbers came from Navarra (20), La Rioja (35) and Cantabria (44).

692 repossessions included second homes like holiday properties- an annual fall of 19.8%.

READ MORE:

- Madrid pledges boost for under-35 first time property buyers with 95% mortgage offer

- Spain’s Government to freeze mortgage payments for families affected by the coronavirus crisis

- Pandemic caused home mortgages in Spain to fall to 2017 levels last year

Click here to read more Property News from The Olive Press.