THE Spanish property market staged a remarkable recovery in 2021 with the easing of pandemic-related restrictions, but the market still faces headwinds that were dragging the market down before the virus came to town.

Anyone who predicted the coronavirus pandemic would lead to a boom in the housing market is a better reader of the runes than I am. Rather like the majority of respondents in a survey I ran back in March 2020, I expected Covid-19 to put the market on a ventilator for at least a year, rather than recover in the second half of 2020, and roar upwards in 2021, which is what happened.

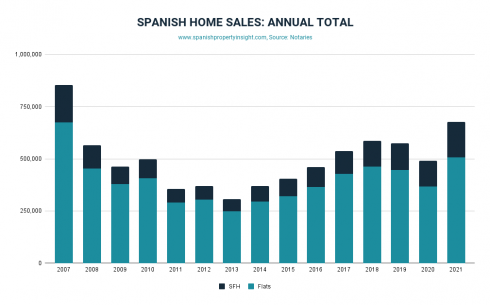

The latest figures from the Spanish notaries’ association show that home sales increased an annualised 38% nationwide last year, and by almost 20% compared to 2019. High growth compared to 2020 was hardly surprising in the light of lockdown, but the growth compared to 2019 has been phenomenal. Sales in 2020 were the highest they have been since 2008, when the market was just coming off the boil after a runaway housing boom.

The figures reveal that the most growth came from the sale of single family homes, up 34% compared to 2019, whereas flats were up a modest 10% in comparison. That confirms a change in demand driven by the virus: People want bigger homes with more space in the suburbs or on the coast near cities and good transport links. Flats in the city centre are out of fashion, for now.

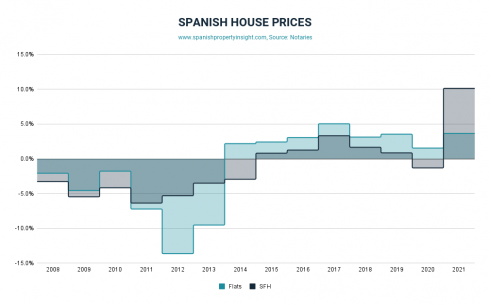

House prices have also performed better than expected (in my survey 57% expected them to “fall a lot”.) In reality they fell just 0.4% in 2020 (recovering in the second half from a slump at the start of the pandemic), and then increased 5.3% in 2021 nationwide. Of course, the national average disguises significant differences between regions and segments, but the overall direction was positive.

Looking at the regions of most interest to foreign investors, the growth in sales last year was most dramatic in the islands, led by the Balearics – up 51% to 17,664 sales – followed by the Canaries up 44% to 24,749 sales. Sales were also above 40% up in Andalusia and the Valencian region, and just below 40% in Catalonia and Murcia.

Compared to 2019, the biggest increase in sales was in Andalusia, up 23%, and Murcia, up 21%. The Balearics were up 11% compared to the pre-pandemic year of 2019, whilst the Canaries were the only region to shrink in comparison to the market pre-covid. So most of the popular regions have more than recovered the ground lost to the pandemic.

Price-wise, the Balearics led the way, with house prices up 14% compared to last year, and 22% compared to the year before that. Andalusia saw the second biggest price increase, up 8% compared to last year, and 7.5% compared to 2019. House prices have not fallen in any region favoured by foreign buyers over the course of the pandemic.

What factors are driving this boom in the market, and where is it heading?

Low interest rates (Euribor -0.502% in December 2021) coupled with high inflation (6.5% in December) are possibly encouraging investors to take advantage of the differential, and get inflation to help pay their mortgages.

A household savings surplus from lockdown might also be helping, coupled with a general reset in people’s priorities. But the headwinds that were dragging down the housing market before the pandemic, including high transaction-costs, high taxes, and political hostility to private property rights are still with us.

The Spanish economy isn’t in great shape either. Housing market expansions usually last five years or more, maybe not this one.

Check out more from Mark Stücklin at Spanish Property Insight for the latest news and analysis to help you navigate the Spanish property market as you buy or sell real estate in Spain.

Click here to read more Property News from The Olive Press.