A DECEMBER 31 deadline for British owners of second homes in Spain to pay their Modelo 210 tax return is fast looming.

Some property owners are still seemingly unaware that they are liable to pay tax on their second home in Spain every year – even if they do not rent the property out at all.

The Modelo 210 non-letting tax applies to all overseas owners who are non-resident in Spain.

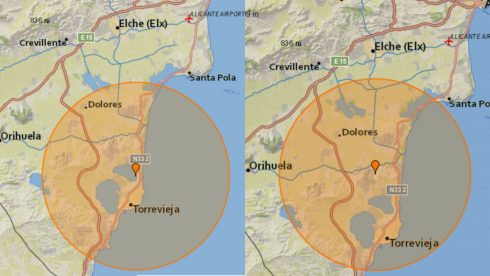

It affects hundreds of thousands of British citizens who own a Spanish property, whether on the mainland or on the islands.

The tax is essentially an annual levy on imputed income as non-resident owned properties are automatically deemed to be a form of income and wealth by the Spanish tax authorities, regardless of whether they are rented out or not.

Helpfully, a new service which saves non-resident owners of second homes in Spain time and money when filing their annual Modelo 210 tax return has just been launched online.

The Spanish Taxes Online website www.spanishtaxesonline.com is an easy to use, one-stop service which enables overseas property owners to file and pay their Modelo 210 non-letting taxes direct online in minutes for a fee of just €59 (plus seven per cent VAT).

This new service can save owners hundreds in fees if they are currently using a lawyer or accountant.

It also saves hours of time and all the hassle of interacting with the Spanish tax authorities if you are trying to file and pay Modelo 210 non-letting taxes independently.

Failure to pay the Modelo 210 non-letting tax can lead to complications with the authorities in Spain, especially when owners come to sell their properties.

Whilst in some instances, fines have been issued and embargoes imposed, with the Spanish authorities extracting taxes owed directly from non-resident bank accounts.

To see how easy it is to sort everything out, just click below to go online to www.spanishtaxesonline.com