Sam Kelly DipPFS, EFA, BA (Hons)

Managing Partner

Chorus Financial

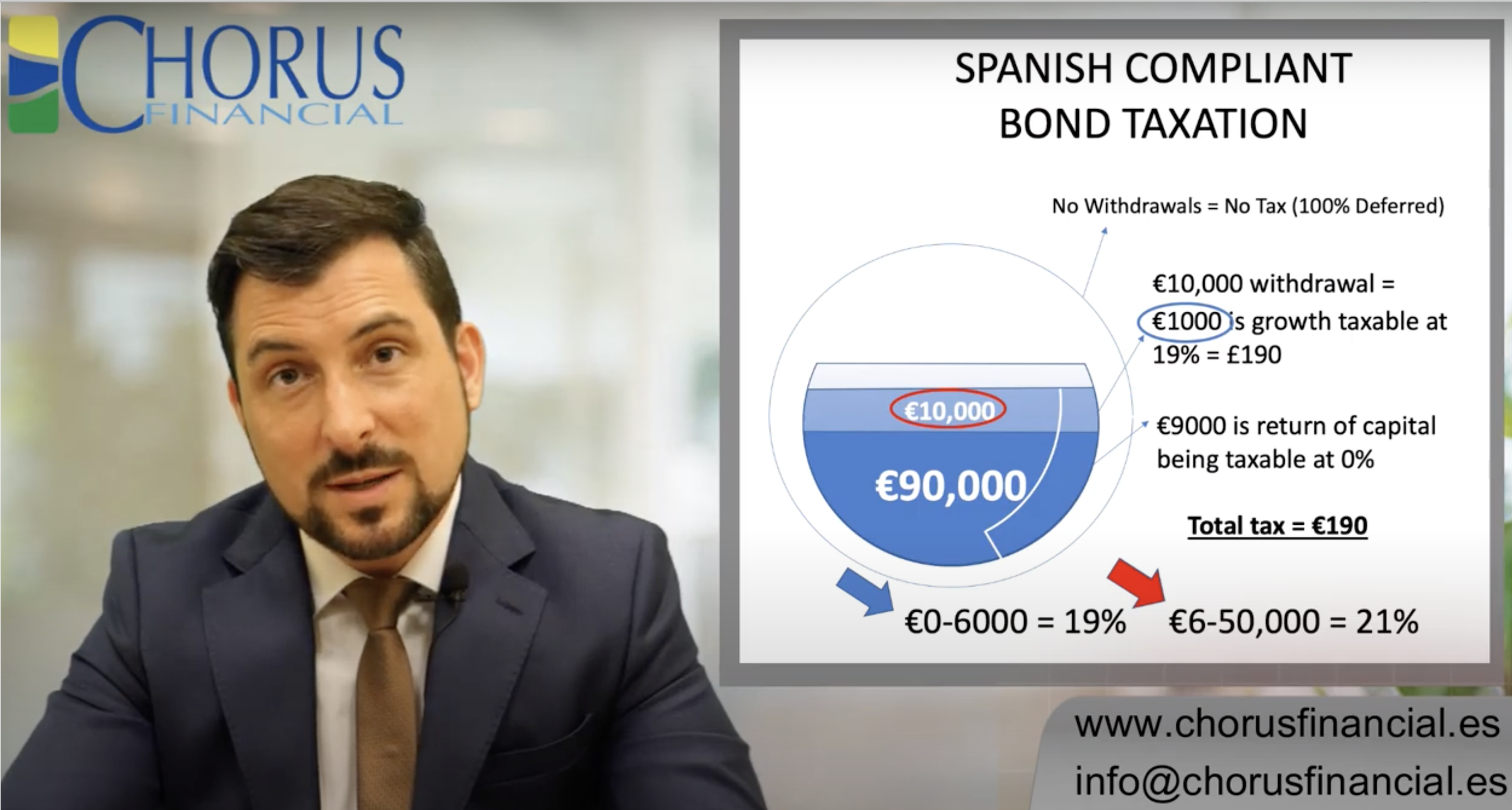

MANY of you will have explored your options for investing as residents here in Spain. In the UK we have ISAs and other tax efficient products, but as soon you become Spanish resident, they lose all their benefits, and in some cases can leave you inadvertently paying an additional 20% tax that you may not even be aware of, and cannot claim back.

One product that 10,000s of Brits in Spain have made use of are Spanish Compliant Investment Bonds. These are effectively tax wrappers that allow you to hold a diverse portfolio of investments in Pound Sterling, Euro and even US dollar. Popular providers include Prudential International, Lombard International, Quilter PLC and SEB.

Regardless of which company you ultimately go ahead with, the tax benefits are all the same, and these products can be very beneficial for those trying to grow their capital or generate an income in as tax efficient way as possible here in Spain.

One thing to be wary of is that the fees can vary massively, even on seemingly the same recommendation, so always get a second opinion, especially with any advice that includes a tie-in, often 5, 8 or 10 years.

I’m only too aware of how many of you out there either already have these products, or are considering opening one, but perhaps do not fully understand their taxation.

To make life as easy as possible Chorus Financial have put together a detailed video that explains the taxation of these products, and we would recommend anyone considering an investment in Spain to go and watch it below.

We also provide more information at https://www.chorusfinancial.es/how-are-spanish-compliant-investment-bonds-taxed/.

Any questions or queries about any type of pension or indeed any Spanish compliant investment here in Spain, including Prudential International, Lombard International, Quilter PLC and SEB, please contact me on s.kelly@chorusfinancial.es or call me +34 664 398 702.