IMAGINE you are driving your car along a Spanish one-way system.

From out of nowhere, a Guardia Civil officer steps into the road, right arm up, left arm pointing at you to pull over… What could go wrong?

Several minutes later, you get a ticket (€1,500) because you had not realised your car insurance had expired.

An innocent overlook, perhaps – but not enough to avoid the fine.

This is exactly what could happen if you missed the deadline to pay your non-resident tax. Read this guide by Costa Blanca-based legal team Sun Lawyers to find out more.

What kind of homeowner are you?

If you own property in Spain, you are within one of the following three groups:

1. Investor, to rent out (not possessing Spanish residency card)

2. Holiday home owner (not possessing Spanish residency card)

3. Permanent home owner (possessing Spanish residency card)

If you’re within groups 1 and/or 2… keep reading please!

Are you a Spanish fiscal resident?

You are a Spanish fiscal resident if you live more than 183 days per calendar year on Spanish territory (and had previously applied for a Spanish residency card).

Otherwise, you are a fiscal non-resident.

However, both fiscal non-resident and resident property owners in Spain are obliged to file annual income tax returns, as the Spanish tax system operates through self-assessment.

The fiscal tax year in Spain begins on the 1st January and ends on the 31st December. Spanish fiscal non-resident annual tax returns are declared in arrears and hence the following year.

How much tax will you have to pay?

There are two main categories here:

- Non-residents in Spain from non-EU member states or non-EEA countries are required to declare income earned in Spain at a general rate of 24%.

- Non-residents of an EU member state or EEA country with an effective exchange of tax information with Spain will be charged a Spanish income tax rate of 19%.

In either category, the general rule for fiscal non-residents is that tax is based on their gross Spanish source of notional income (benefit of having an asset), net rental income and on capital gains arising from assets located in Spain.

You are a non-resident and property owner, what taxes should you pay?

Before we dive into it, there is an important rule you should keep in mind. When property is owned by more than one person, each person will be an independent taxpayer who will have to declare separate tax returns.

The income tax amount will depend on the use of the property:

A) Notional income tax on properties in private use

Let’s say you were not the owner of the property during the whole year. In this case, you would only pay notional income tax that would apply to the period where you were the actual owner. This same formula would apply if you rent your property out.

Notional income tax is calculated according to the calendar year – 1st January to the 31st December.

B) Income tax on property that is rented out

The rule here is: non-resident property owners who rent out their property are obliged to declare the total amount received and are taxed over the net income.

Unlike notional income, this kind of tax is declared quarterly as follows:

· 1st-20th April (1st quarter)

· 1st-20th July (2nd quarter)

· 1st-20th October (3rd quarter)

· 1st-20th January (4th quarter)

Have you got any questions on non-resident tax? If so, then please do let us know.

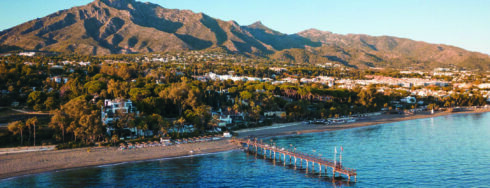

Sun Lawyers is a Spanish law firm founded in 1985 with more than 30 years experience. Our team of English-speaking Lawyers represent both residents and non-residents of Spain in all aspects of Legal, Fiscal and Property Law. At Sun Lawyers we pride ourselves in giving every client a personal experience however, as a majority of our clients remain in the UK throughout the buying process we have become experts in dealing via email or phone.

Email: admin@sun-lawyers.com