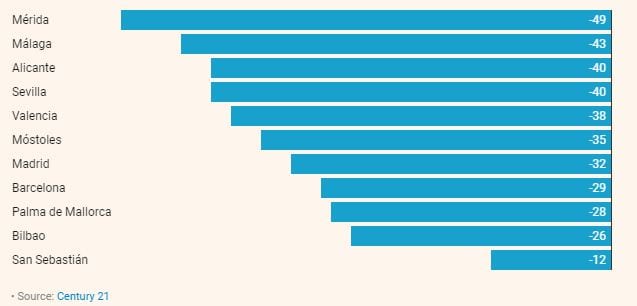

BUYING a property is cheaper than renting in most parts of Spain, according to new calculations.

In 15 major cities it is far cheaper to pay a mortgage than to pay a landlord rent, it has been discovered.

According to the findings in none of the major cities did the cost of a mortgage come above 31% of the average family earnings.

In some cities, such as Merida, the price of renting is as low as 8% of the average salary, found the report by global estate agency Century 21.

In Sevilla, the cost of buying with a mortgage came to just 19% of the average salary, which is €2,671 a month, while in Valencia it was just 16% of €2,776.

Rental outlay in the same two cities, meanwhile came to 32% and 26% of monthly earnings.

In Murcia – where the average salary is €2,683 a month – tenants are paying 20% on rent, while owners pay just 11% on a mortgage.

Another example showed that the owners of a 90-square-metre apartment in Madrid pay a mortgage of €960 per month, while tenants are paying €1,419 per month, an alarming 40% of a family’s income.

Only Barcelona cost more to rent at 44% of average earnings, while Palma in Mallorca cost 34%.

“Renting has become a necessity for many people who can’t afford to buy.” explained CEO of Century 21 for Spain and Portugal, Ricardo Sousa, said:

“Today, major cities around the world face the challenge of providing affordable and adequate solutions.

“This is especially the case in large cities such as Madrid and Barcelona, ??where there is strong population growth, while housing options with affordable prices are scarce.”

Renting costs in Spain have jumped by 50% over the last five years, according to a study by the Bank of Spain, using data collected by Idealista.

Almost 23% of Spain’s population rent property, significantly less than the European average of 30%.

Click here to read more Spain News from The Olive Press.