THOMAS Cook has collapsed into insolvency, leaving 150,000 holidaymakers in Spain and other countries stranded.

The UK Civil Aviation Authority (CAA) said the 178-year-old holiday firm had ‘ceased trading with immediate effect’.

The CAA will now conduct the biggest peacetime repatriation, after it ‘secured a fleet of aircraft from around the world’.

Holidaymakers are to be brought home over the next two weeks from Monday September 23 to Sunday October 6.

The CAA said a ‘government scheme will guarantee hotel costs for ATOL-protected holidaymakers’.

It has also launched a special website – thomascook.caa.co.uk – where ATOL and non-ATOL customers can find the latest information on flights and accommodation.

Tourists scheduled to return to the UK in the next 48 hours, can also call 0300 303 2800 in the UK or +44 1753 330 330 for assistance.

The CAA has also launched a process to ‘manage all refunds by Monday September 30 ’.

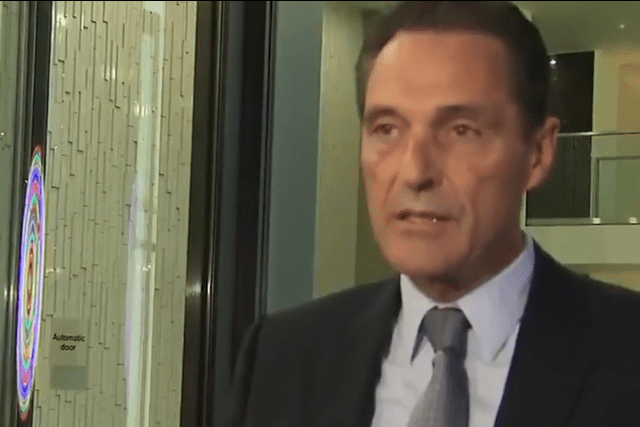

Thomas Cook’s chief executive, Peter Fankhauser, said it was a ‘matter of profound regret’ that the holiday company had gone under.

He also issued an apology to the firm’s ‘millions of customers, and thousands of employees’.

The compulsory liquidation now puts 22,000 jobs at risk, including 9,000 in the UK.

CAA CEO, Richard Moriarty, said: “News of Thomas Cook’s collapse is deeply saddening for the company’s employees, customers, hoteliers and other suppliers and we appreciate that more than 150,000 people currently abroad will be anxious about how they will now return to the UK.

“The government has asked us to support Thomas Cook customers and we have launched a programme to bring them home, which also includes costs to hotels accommodating Thomas Cook customers under the Air Travel Trust’s ATOL scheme.”

The collapse of the UK’s oldest travel agency comes after it was denied an eleventh-hour government bailout of £250 million.

High-street-focused business and huge debts were cited as reasons for Thomas Cook’s collapse by UK Transport Secretary Grant Shapps.

UK Prime Minister Boris Johnson speculated that it could be time to ‘reflect on whether the directors of these companies are properly incentivised to sort such matters out’.

Click here to read more Spain News from The Olive Press.