Avoid paying fines by declaring your rental income in Spain before the deadline

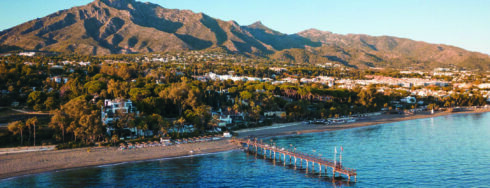

How can the Tax Office know if you are renting out a property for short stays? – one may ask. As Malaga and Costa del Sol become increasingly popular for tourists visiting Spain, many landlords have seized the opportunity to earn some extra income by letting out their properties. Before internet hospitality platforms emerged as a new trend, this sector wasn’t attracting that much attention in Spain and it remained relatively uncontrolled. But as local property owners started to make substantial profits and cities were flooded with tourists, Hacienda decided to impose stricter controls on holiday rentals.

From that moment on, every landlord renting out a property in Spain is obliged to register it officially, to obtain an “occupation permit” and to comply with certain health, usability and bureaucratic requirements (i.e. ventilation, furniture, air conditioning, heating).

What can happen if you don’t declare your rental

“What many landlords don’t know is that the actual internet platforms like Airbnb, Spotahome and Homeaway have to report their rental income (including the person who generated it) to the tax authority through Form 179” – informs Rosana Tejada, tax consultant at Tejada Solicitors. “So even if landlords are non residents and they don’t report this income, Hacienda will eventually know about it.”

To avoid paying fines, non-residents who are renting out a property in Spain must declare their earnings submitting Form 210 (IRNR, Impuesto sobre la Renta de no Residentes sin establecimiento permanente). Form 210 is to be submitted quarterly during the first 20 days in April, July, October and January. Read more on the blog of Tejada Solicitors:

https://tejadasolicitors.com/blog/renting-out-a-property-non-resident/

In contrast, resident taxpayers will need to include this income in their yearly tax return, which will be taken into account when calculating income tax (IRPF).

Another tax which needs to be considered when renting out to tourists for short stays is VAT. In general, holiday lettings are VAT exempt. But if hospitality services, such as laundry, meals or a regular cleaning services are offered, as it happens in hotels, the rental is subject to 10% VAT.

Last but not least, if the landlord signs a sublease contract with a third party (as for example, a broker agent or a booking platform), allowing them to re-rent the house or apartment, the rental will be identified as commercial (e.g. not focused on providing common housing) and VAT will be increased to 21%.

In each of these cases, a professional tax specialist will be able to offer tailored advice and consider the characteristics both of the property and services offered. If you are seeking professional guidance by an English speaking tax consultant, you can contact the Tejada Solicitors, who hold offices in Malaga, Marbella, Fuengirola, Nerja, Torrox, Velez Malaga and Torre del Mar.

Rosana Tejada (Tax Advisor)

TEJADA SOLICITORS

Phone + 34 952 558 228

mail: tax@tejadasolicitors.com