THE recently enacted Real Estate Credit Act 5/2019 has left no one indifferent.

There are those who applaud a reinforced protection for consumers – traditionally seen as the losers in the lender-borrower equation.

There are the more selfishly-inclined who predict a sharp decline in real estate transactions due to the obvious hassle of formalising an even more complex procedure. While national news headlines show little sympathy for a law seemingly written up to prevent bank abuses in the last boom-crisis cycle.

El Mundo’s read: ‘New Mortgage Law: Notaries in a mess, tougher lending criteria and…property sales dropping?’

El Economista: ‘The New Mortgage Law will make it more difficult for younger borrowers.’

Idealista: ‘Mortgage law madness: last-minute rush of banks and notaries to avoid a slowdown in sales.’

El Español: ‘First cock up with the new Mortgage Law: banks and notaries fail to synchronize their electronic register.’

But what’s the deal with this law and why are so many reporters up in arms? The answer is not straightforward.

Whilst most recognise the underlying bona fide mission of protecting consumers, intensified credit checks on borrowers and the intricate pre-contractual stage of new loan agreements can only be deterrents for new business.

To qualify for a loan, any borrower will have to visit a Notary office 10 days prior to closing on the purchase sale to undergo a test; in it, the Notary public will have to evaluate the borrower and his understanding of the document he/she will be signing in 10 days’ time.

More so, the Notary is to provide the borrower with two key documents forwarded by the bank: the ‘FEIN’ (the European Standardised Information Card) and the ‘FIAE’ (Standardised Warnings Card) that includes mortgage parameters (opening commission, early maturity due to non-payment and what expenses are applied in this case) and a few other fairly elaborate items and mathematical formulas.

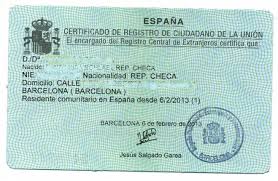

Not easy? Now imagine a foreign buyer who speaks no Spanish and a notary who speaks only Spanish and you have a deal-breaker.

Not to mention the non-assumable 10-day period for busy investors and the yet-to-be defined role of lawyers here: advisers or just translators? Time will tell.

Click here to read more News from The Olive Press.