Elaborating economic premises is not an easy task, especially if the object of analysis involves a compendium of countries such as those that make up the European Union. Although often these approaches are not decisive, they are an important source of consultation when you plan to invest in this part of the world.

The large countries that comprise this community of nations have structured action plans aimed at stimulating a rebound in their economic growth by the year 2019. Motivated by this, a series of measures proposed to achieve in an organic way the strengthening of their economies.

It is not surprising, then, the application of expansionary policies aimed at achieving similar percentage growth for its members, the creation of sources of employment and the maintenance of the usual strict fiscal management as effective collection measures.

Economic policies that the countries of the Union are implementing to achieve their objective

- Internal organization of the economies of the region: focused on internal development, seeking to reduce political risks, with a much narrower orientation in terms of strengthening wages that promote employment.

- Emphasis on fiscal expansion: it is the result of an increase in demand, consolidated by an effective wage policy that increases GDP and, therefore, the purchasing power of the population and promotes social welfare.

- The joint work of the most solid members of the union: a measure that involves the use of their tax bases to invest in the promotion and development of the economic platforms of the members.According to information from El País newspaper, in its economy section, Germany, France, and Holland, by having a more comfortable fiscal position, they lead the incentive plans for the development and economic rebound of the Euro Zone.

- Encourage investment plans: this is achieved through the strategy of using community funds. In this sense, the investment would not only be more solid, but much more effective, since it is the result of the fiscal space that many members count on, and that, ultimately, will result in common welfare.

El País, in its economic section, also indicates that this cooperation between members implies not only the support of powers such as Germany, France, and Holland. According to their information, it is estimated that more than 18 countries inside and outside the Euro Zone will echo the measures aimed at boosting economic growth.

To harvest in times of storms

Another factor that favors the rebound of the European economy for the remaining of the year 2019, is that it is considered that the countries of the Union will be the great beneficiaries of the trade war that keeps the US and Chinese markets in conflict.

In this sense, fishing in troubled waters is not a negligible idea for the countries of the European Bloc, especially if the premise is to maintain the winds in the stern, which for a long time led Europe to grow much faster than the American economy.

Reports obtained from the United Nations Conference on Trade and Development (by its acronym UNCTAD) indicate that the countries that make up the European Union bloc could be the great beneficiaries of an amount equivalent to US$ 70,000 million, coming from the already deteriorated commercial relationship between China and the United States.

The analysis details that the figure consists of US$ 50,000 from exports that China carries out to the United States, and US$ 20,000 corresponding to US exports to the Asian country.

On this basis, it is obvious to understand why the countries of the European Bloc will get the best out of this commercial fight.

Countries that make up the engine for the rebound of the economy of the European Bloc

Maintaining growth in an environment of uncertainty due to economic slowdown forecasts is an arduous goal. Most experts agree that this titanic work will fall mainly on the emerging economic and those in development.

Of the group of European nations, the mission to maintain the engine of the economic rebound is in charge of countries such as Malta, which until now continues to be the fastest growing block, followed by the Slovak Republic.

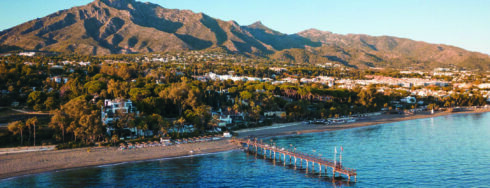

However, the support is also strengthened by the intervention of portentous economic models such as those from Germany and France, who intend to maintain their growth rates in favor of the upturn. Other countries also generate their contribution to this goal, although in a lesser amount, as is the case of Spain. This nation cedes positions in the ranking; however, as indicated in the El País economy section, for the year 2019 the GDP of the Spanish country will rise by 2.2%, contributing to the group goal.

Online Casinos as a source of economic growth

Gambling is a big source of contribution to the economic growth of the European region. Undoubtedly, its development favors the economic reactivation of the countries that host them as a sustainable source to promote investments.

The diversity involved in favoring its operation will be offset by the generation of employment sources, the attraction of powerful capital investments and the generation of income for the state coffers derived from the tax burden generated by its actions.

Spain is one of the countries of the Union that has made the most out of these sources of economic growth. The webpage mejorcasinoonlineespanol.com is a clear example of this. This website brings its services directly to customers and has attracted ambitious investors to the Spanish nation, achieving great revenues.

Take advantage of positive market trends

Taking advantage of creative options such as those offered by the Spanish portal mejorcasinoonlineespanol.com, and other alternatives for sustainable economic development, should not be neglected, especially when the ideal is focused on joint community growth.

If one considers that studies perceive the gaming sector as destined to become the pillar of the world economy, everything takes on another meaning. The interesting thing is that this happens despite the common criticisms that are presented against casino franchises and their addictive power.

In this sense, the true challenge of the sector will be to regulate it carefully and intelligently to favor its operation, creating a robust legal framework that allows reducing the growth of organized mafias and money laundering associated with it.