EXPATS in Mallorca have slammed the lack of action over a foreign exchange firm collapse, despite British authorities claiming an investigation is ‘a matter of priority.’

Dozens of clients, most of them British expats, lost millions of euros when the Palma-based company Premier FX suddenly stopped trading in July last year.

Victims have demanded answers but have been left completely in the dark and unable to access their funds since then.

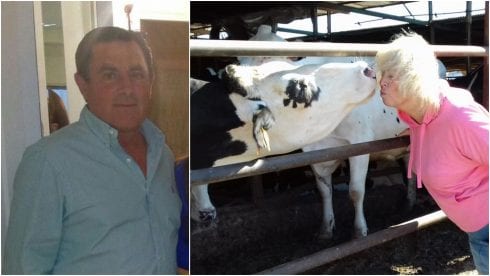

One expat, based in Cas Catala, Pam Gardner has grown frustrated at attempts by the UK’s Financial Conduct Authority (FCA) to ‘wriggle’ out of responsibility.

“People in the UK just think it was a case of rich expats with too much money, they don’t realise it was people’s life savings that were lost, money they planned to retire on,” she told the Olive Press this week.

She added she was ‘upset’ that local boss Nick Jones has apparently washed his hands of the case and ‘fled’ the island.

She has now launched a civil case against the firm, lodged in Palma.

It comes despite British MPs now stepping in to demand the FCA probes the case ‘as a matter of priority.’

MP for Dover, Charlie Elphicke, has now met with the authorities to check on progress of the case.

He said, this week: “The FCA must treat this investigation as a top priority. Innocent people have been left in terrible financial hardship.

“The authorities need to get to the bottom of this urgently.”

The move comes after the firm – which operated from Palma, Portugal and London – suddenly stopped trading on July 27.

Victims told the Olive Press last year that they had lost up to €400,000 each in life savings after the company was forced into administration by the UK authorities.

An action group was formed and now has well over 200 members – many of them in the Balearics – demanding immediate answers.

One claimed an initial investigation by Surrey police had apparently been scrapped due to ‘insufficient funding’.

The company had been regulated by the FCA for money transfer services but its customers were encouraged to deposit funds, to be used as a type of savings vehicle.

It did not have a licence to offer this service, it has since emerged.

The company appeared to have got into trouble after its owner Peter Rexstrew died suddenly in Mallorca.

The Olive Press can reveal that he had recently started renting a new property in the exclusive Portals area, with a new girlfriend, when he passed away.

The pair had been seen out enjoying expensive meals and ‘living the high life’.

The FCA did not get back to the Olive Press before deadline.