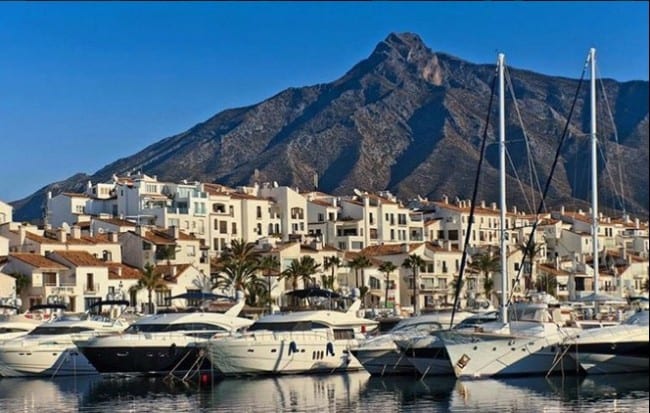

WE all remember the horrific aftermath of the 2008 property crash in Spain.

It’s why the recent warning from the International Monetary Fund may have been a cause for concern for many a homeowner or investor.

The government lender claimed it had detected early signs of ‘a slight overvaluation’, advising Spain to begin monitoring its property market more closely.

“It is critical that the Bank of Spain has a comprehensive toolkit at its disposal so that it can act promptly should misalignments emerge,” the IMF said in its annual report on Spain.

“The authorities need to be vigilant. The set of macroprudential tools should be expanded to deal with potential financial stability risks.”

But let’s not carried away.

While house prices have increased by around 15% between 2014 and 2017, sales are being driven by existing housing stock rather than new housing.

Additionally, homeownership rate has dropped from 80% to 77% as people are turning to the rental market, while the Spanish economy is much more stable than it was prior to the 2008 bubble.

The growth in house prices is not being matched by a rise in credit flows while private debt levels are remaining stable and the country’s balance is positive – a far cry away from the days when it was borrowing around €100 billion each year.

It means a bubble is far less likely, but it doesn’t mean Spain should shy away from bringing in new tools to stave off another crisis.

The Bank of Spain already has levers it can employ to limit mortgage approvals – when necessary – based on the value of the home, the borrower’s income or payment deadlines.

Spain should also be vigilant to systemic risk in order to prevent the emergence of imbalances or bubbles.

As the country’s property market continues its healthy progress, Spain can put measures in place to prevent another disaster, however unlikely it may seem at present.

A previous proposal which called for bringing the Bank of Spain, the CNMV watchdog and Economy Ministry together into one agency would be a welcomed idea.

In the end, it is up to the Bank of Spain to encourage responsibility within the mortgage market but only when necessary.

Click here to read more Spain News from The Olive Press.