A BATTLE is brewing between consumer groups and lenders over negative interest rates on mortgages.

With billions of euros at stake, lawmakers and consumer groups in Spain and Portugal are arguing that lenders should pay up when mortgage rates drop below zero.

The banks however are not lying down and have begun their counter attack.

In Spain and Portugal, banks typically tie interest rates on mortgages to the euro interbank offered rate, or Euribor, a fluctuating rate banks pay to borrow from each other.

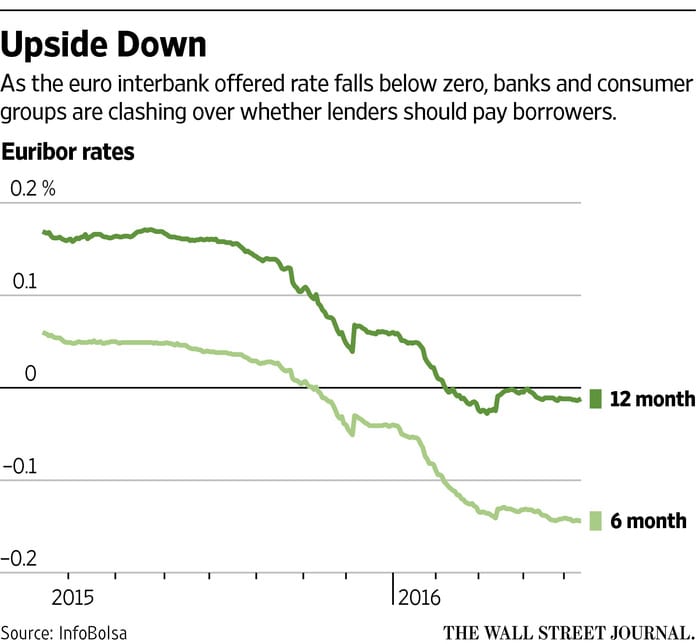

However, the Euribor has been in freefall since the European Central Bank cut interest rates below zero—charging lenders to hold deposits—to stimulate the continent’s economies. Effectively, the banks are paying to park their money with the European Central Bank overnight. The thinking behind this is that, by doing so, the banks will be more inclined to lend out their funds rather than incur this extra cost.

That has already pulled mortgage rates below 0% in a few cases in Portugal but, as banks make their money by charging a margin over their cost of borrowing (whether from the central bank or individual savers, like you) this is unlikely to occur everywhere.

However, lenders are already taking steps to protect themselves as they prepare for further steep drops.

The fightback has already begun across the border, with Portugal’s Central Bank governor attempting to sabotage a proposed law that would require lenders to pay up when interest rates turn negative.

As the alarm bells begin to toll, lenders across the continent are now manically attempting to rewrite mortgage contracts so that homeowners can never profit from subzero rates. In Spain, notaries are requiring borrowers to sign a disclaimer to say that the minimum rate they will ever pay is 0%.

But, it may all be in vain, as Europe already has a precedent, with banks in Denmark paying out thousands on their home loans after the central bank introduced negative interest rates.

Despite this bank executives in both Spain and Portugal have said they would pay borrowers when pigs fly.

“In no case could a client receive interest payments because that would go against the nature of a loan,” Banco Bilbao Vizcaya Argentaria SA CEO Carlos Torres Vila said. “In the most extreme case, a borrower would pay zero interest.”

In Spain, most mortgages are tied to a 12-month Euribor rate, which is currently at minus 0.012%. That rate would have to fall a lot further to offset the lowest spread on mortgage loans, which were locked in during the country’s property boom a decade ago.

In that event, Spanish consumer groups, OCU and Adicae are arguing that the banks would have to pay up.

However, Spanish banks claim they are protected by a Madrid ruling in 2014 that would give them legal backing to their refusal to pay interest to borrowers.

Only time will tell, but interesting times lie ahead if and when the Euribor drops further.

Click here to read more News from The Olive Press.