THE British pound will fall sharply in the case of a Brexit, the Bank of England has warned.

THE British pound will fall sharply in the case of a Brexit, the Bank of England has warned.

The UK central bank made the stark warning as it announced it would be keeping interest rates at 0.5%.

It said the recent devaluing of the pound shows how a Brexit would cause it to fall even further, ‘perhaps sharply’, while households would delay spending, leading to lower demand and a rise in unemployment.

“The outcome of the referendum continues to be the largest immediate risk facing UK financial markets, and possibly also global financial markets,” the Monetary Policy Committee statement read.

It added that commercial and residential property transactions, car purchases and investments have all been affected by the uncertainty in the market.

People are delaying major economic decisions.

“Households could defer consumption and firms delay investment, lowering labour demand and causing unemployment to rise,” it said.

The British public go to the polls on next Thursday.

This will be fantastic news for the British economy, exports up, imports down, great. Happy days for the balance of trade.

The UK does not produce nearly as many tangible exports as it used to. The UK’s service sector may have recovered to levels seen before the financial crisis, but manufacturing has not recovered.

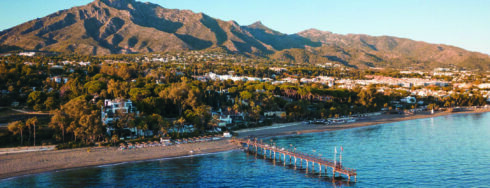

Tell that to expat pensioners Peter, whose pensions, paid in pounds, will buy considerably fewer Euros.

So, crappy days for old ‘uns.