THIS is my favourite time of the year.

The weather is warming up but the summer hordes have yet to descend upon us (anyone reading this abroad will however be most welcome!).

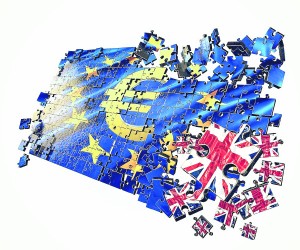

The spring of 2016, however, is likely to be remembered more for the momentous ‘Brexit’ referendum, the implications of which could affect us for years to come.

Just to add to the uncertainty, of course, there is also the second Spanish general election in six months on June 26. And, lest we forget, a US presidential election looms later in the year.

Economically, the euro zone is most definitely not out of the woods.

China’s slowdown continues to threaten us and global terrorism is a real concern. The list goes on and on. It might just be my age but I sense that the world has not experienced such uncertainty for many years.

Readers will follow developments in The Olive Press and other media, no doubt.

But there is little we can do to mitigate all this uncertainty. It won’t go away and short of casting our votes in the referendum and elections as and when they are called, what else can we do?

As always, I look at this from a financial perspective because the markets hate uncertainty – and volatility in share prices, currencies and commodities may affect us all financially.

Even the possibility of ‘Brexit’ is likely to lead to a fall in the pound’s value. Pundits also warn that the euro itself might wobble too (the idea being that a UK exit is bad news for the EU generally) – but nothing is certain. If you are considering a large transaction that involves a currency exchange, such as a property purchase (or sale), then it might well be worth considering locking in the rate now.

Certain asset classes could also be affected by the various threats that surround us now; so take the time to speak to your financial adviser to ensure that your portfolio is adequately diversified and is not over-exposed in any one sector.

Almost ten years of global financial upheaval has had a drastic effect on pensions. Final salary arrangements, for instance, are almost unheard of today but there are many new products designed specifically for the internationally mobile. It may be wise to consider your options; particularly if you recently arrived in these parts but retain a UK pension – or, indeed, if you are considering a return home after years of expat life.

Uncertainty may leave you feeling anxious about succession issues. A regular review of your will is always recommended to ensure your current wishes are reflected. Depending on circumstances, which would include your nationality and country of residence, a trust may also be a suitable option to provide more certainty. As always, professional advice should be sought.

So is anything certain? Well, we can be sure in this part of the world at least that the sun will be shining. And, of course, you should counter any uncertainty that this might bring by using the right sun block! It’s going to be an interesting summer.