By Matthew Harris, Cambridge FX

By Matthew Harris, Cambridge FX

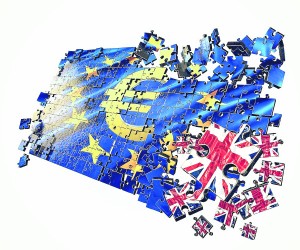

POLITICAL uncertainty is never good for a currency, and we have seen Sterling suffer tremendously over the last few months, as the Brexit referendum date approaches.

I should preface this article by stating that before a June referendum was announced, Sterling had suffered a 12-cent drop from over 1.42, edging under the 1.30 mark in the preceding three months. Whilst that decline was mostly due to interest rate expectation adjustments, it is likely that the potential for a Brexit also weighed on the Pound.

If Britain does indeed vote to leave the EU and go it alone, most analysts agree that the Pound is likely to suffer, certainly in the short term. Goldman Sachs are suggesting that it could be as much as a 20% decline in Sterling’s value overnight, which would put levels near parity in sight, as we saw (but did not quite reach) in 2008/2009.

Given that experts are split on what the result of the referendum is likely to be, the risk of trusting one side over another seems rather high. As a result, for anyone with a large future currency exposure, the question they should be asking has shifted from “What is going to happen with the result” to something more akin to “How do I want to manage the currency risk”.

Whether you are selling Sterling to buy another currency, or have incoming Euros or Dollars to sell back to Pounds, you are likely to be profoundly affected by this event, and it could be a double-digit move. It may be tempting to take the risk that the result (and market) will both be as you want them, but in practice, hope is not a reliable economic tool.

We have seen a significant increase in clients employing hedging strategies to protect themselves from adverse market movement. Hedging isn’t a technical or scary term, in this case it just means contingency planning. The most common strategy is to use a forward contract, which allows you to lock in the exchange rate at the current level, then when you need to use the currency, that is the rate you get. Forwards aren’t for everyone, and you should speak to your account manager about the cons as well as the pros before you decide to take one out. They normally require a deposit of 5%, and if the market moves against the direction you have protected, you may be required to pay an additional deposit or margin call.

If you’re buying a property and have a large amount of Euros to purchase after referendum day, a forward contract will give you the peace of mind of knowing exactly how much you will have to pay, regardless of where the exchange rate sits. Sadly, if the exchange rate rises, you will still be locked in at a lower level with your forward – the purpose of this contract is not to speculate on which way the market will move, but to eliminate this risk entirely and accept the current level.

For more information visit www.Cambridgefx.co.uk or pop into the office at:

Cambridge Mercantile Corporation (UK) Ltd Sucursal en Espana

Local 6, Centro Comercial Andasol

KM189, N340

Marbella

Malaga 29604

Click here to read more News from The Olive Press.