LIVING in Spain as a UK ex-pat should be no deterrent from using a UK fund supermarket platform to self-manage and improve the return on some of your savings.

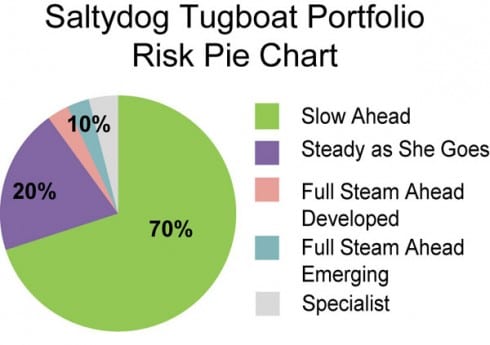

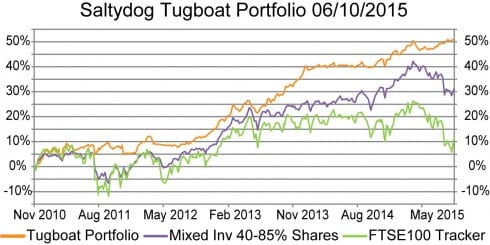

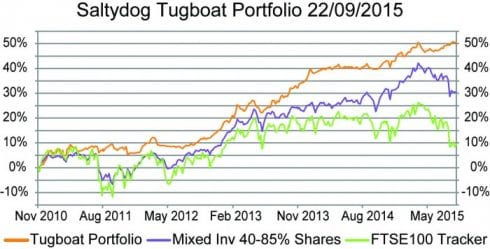

It makes sense to try emulating the 49% achieved in four years by the cautious Saltydog Tugboat portfolio, rather than watch your money stagnating in a cash ISA, earning – if you are lucky – perhaps 12% over the same period.

When I first decided to take control of my finances, the world was a very different place from today. There were no ISAs or SIPPs and a supermarket was where you went to buy your groceries.

Moving your investments around was frowned upon and inevitably involved the services of an I.F.A. (Independent Financial Advisor). It was expensive, slow, and required the signing of forms in triplicate.

At the same time, unit trust fund performance data was hard to come by and inevitably out of date. Today this is no longer the case. Now, with the advent of fund supermarket platforms, costs have tumbled almost to zero and changes to your ISA and SIPP portfolios can be made by yourself, on your own computer, at the press of a button. The age of the D.I.Y. investor has finally arrived.

Fund supermarkets are online ‘platforms’ that allow investors to buy and hold a range of unit trust funds from a vast array of fund management companies, all put together in one portfolio.

The value of this portfolio is ring-fenced and belongs to you, never to the platform. Different platforms have different charges for the service that they offer.

There are some people who protect their costs with the fervour reserved for nuclear bomb codes. I, conversely, work on the principle that fund supermarkets, just like Tesco`s and Sainsbury’s, want your business and will therefore be competitive. Much more important is that the platform I choose carries the largest choice of funds so that I can have the best-performers in the best-performing asset sector – how and when I want it.

The fund supermarkets want to help you transfer some of your investments onto their platform. They all have helplines and, in my experience, the staff are well-informed and happy to assist. The table at the end of this article lists a few well-known platforms. If you go online and search for ‘fund supermarkets’ you will find many more.

This first step can be very frightening for many people, but when it is completed you will wonder what all the fuss was about.

I would strongly advise anyone who wishes to improve the performance of their savings to visit the Saltydog Investor website and run through the ‘How to’ section. It will cost you nothing. Then, if you wish to go further, there is a two-month free trial to help familiarise you with the process. Go to www.saltydoginvestor.com for more details.

| Fund Supermarket | Website | Helpline Number |

| Hargreaves Lansdown | www.hl.co.uk | +44 117 900 9000 |

| Bestinvest | www.bestinvest.co.uk | +44 20 7189 9999 |

| Alliance Trust Savings | www.alliancetrustsavings.co.uk | +44 1382 573 737 |

| AJ Bell ‘Youinvest’ | www.youinvest.co.uk | +44 845 54 32 600 |

| Charles Stanley Direct | www.charles-stanley-direct.co.uk | +44 131 500 1212 |

| Nutmeg | www.nutmeg.com | +44 20 3598 1515 |

| Interactive Investor | www.iii.co.uk | +44 845 200 3637 |

| Fidelity Personal Investing | www.fidelity.co.uk | +44 800 41 41 61 |

| Barclays Stockbrokers | www.barclaysstockbrokers.com | +44 800 279 6651 |

| Cavendish Online | www.cavendishonline.co.uk | +44 3456 44 25 44 |

| TD Direct | www.tddirectinvesting.co.uk | +44 345 607 6001 |

| iWeb (Halifax) | www.iweb-sharedealing.co.uk | +44 3450 707 129 |

| rplan | www.rplan.co.uk | +44 333 222 3733 |

Click here to read more News from The Olive Press.