WHAT was the point in trying to second guess how the recent episode in the Greek tragedy would end?

WHAT was the point in trying to second guess how the recent episode in the Greek tragedy would end?

Without a direct feed into the brains of the Greek Prime Minister, Alexis Tsipras, and the German Chancellor, Angela Merkel, and their negotiating teams, we and the media were mere spectators to the event.

The best that we could do for our investments was to be cautious, and protect them as best we could by heading for a safe haven until one or the other side waved a white flag.

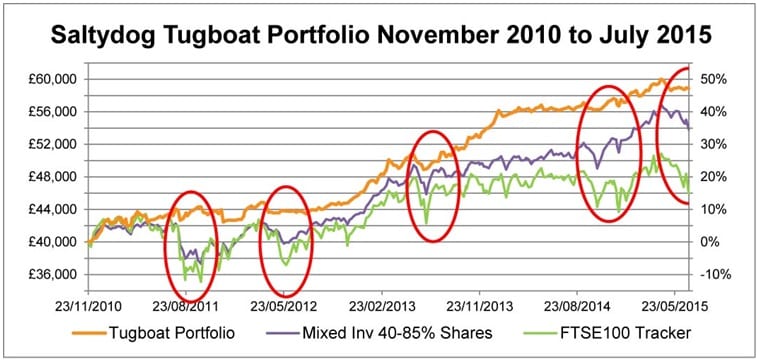

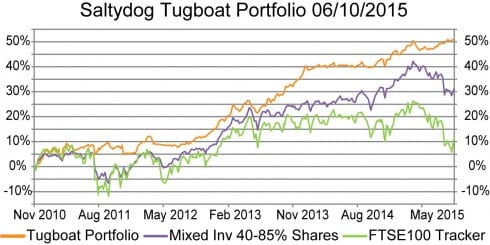

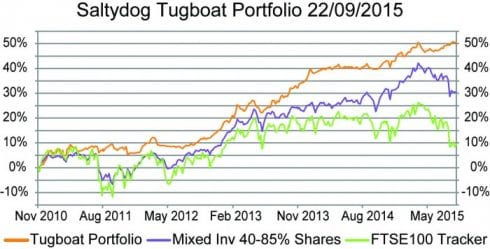

Looking at the graph, it is good to see that the Saltydog Tugboat cautious portfolio has managed yet again, for the fifth time since its conception four years ago, to avoid a major market fall.

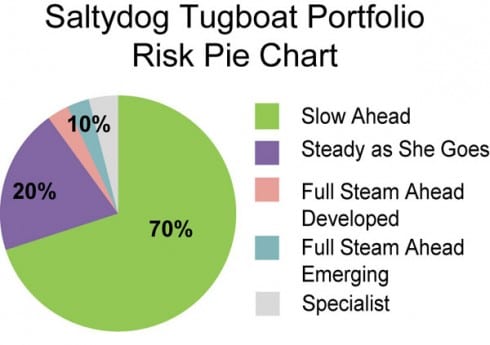

Is this a coincidence? Of course it is not, it is down to the fact that the portfolio is actively managed inside the restrictions imposed by a cautious risk pie-chart.

There are many people who decry active trading and promote a passive approach to their investing, saying that it is not possible to avoid these market dips and that it is expensive to keep changing your fund selection.

Ten years ago this might have been true, but now that is simply nonsense. In today’s world it only costs an annual platform charge of €640 per €142,000 of portfolio to trade as frequently as you like, and if you are using OEICs there is no further cost.

Knowing of the existence of the Saltydog slow property funds meant that you could hide your money there and still earn a reasonable return until this particular storm passed over.

I am sure that there must be a medical term for those passive investors who appear to revel in experiencing these regular market drops saying that it will be better tomorrow.

This form of flagellation is not for me, instead I feel that being active keeps both me and my investments fit, and is certainly better for the soul and the bank balance.

For a better understanding of our practical approach to momentum investing in funds, and for more details of our demonstration portfolios, visit the Saltydog website. www.saltydoginvestor.com

Click here to read more News from The Olive Press.